Last Updated on February 19, 2024 by Grant

First and foremost, you can travel and you can travel well. We are NOT wealthy people. We are Georgia public school teachers. While we make a comfortable living, we do not have a secret source of income to keep us traveling for up to 10 weeks out of the year. So, we have to practice good travel finance decisions.

There is no secret to being able to travel, just like there is no secret to losing weight: Quite simply, we keep expenses low, we budget and we save.

(Disclaimer: When we link to places where you can buy our stuff or places we stayed, we are using special codes that earn us commissions on the sales at no additional cost to you. Please see our Review Policy for more information.)

Travel Finance 101 – What to Do Before You Start Planning a Trip

Being able to travel truly starts with your day-to-day living and spending. So, let’s take a look at how we budget our everyday expenses.

Keeping Expenses Low

Disclaimer: we don’t have kids. That is a huge deal financially. We know that. But there are plenty of folks out there who travel more than we do and take their kids with them.

First, we have one vehicle. Bonnie and I work at the same school and ride together to work every day. That is a significant financial advantage and, most of the time, it works just fine for us.

If this doesn’t work for you, there are ways around having more than one car payment at a time. It may mean making a car last for several years after you pay it off, but limiting yourself to only one car payment at a time will save you a ton of money.

We don’t live in a giant or expensive home, either. Rather, we own a 1,200 sq. foot, one-bedroom, 1.5 bath condo. The mortgage and condo fees are cheaper than rent in our area, but we still pay extra on the mortgage every month to pay it down faster. Yes, we sacrifice being able to grill out, but we get peace of mind when we go on the road… We don’t have to worry about a tree falling on our home while we are in Italy for a month. It is a trade-off, just like everything in life.

Experiences, Not Stuff

Space is tight in our condo, so when something comes in, typically, something else must leave. That means we don’t relish buying things nearly as much. We typically do not buy gifts for each other for either Christmas, birthdays or anniversaries. We buy trips, experiences or needed big-ticket items, instead.

Our last anniversary? We ate at a very nice restaurant at the chefs’ counter! We may not have anything to “show” for the experience, other than a few photos, but the memories will last a lifetime.

Call us minimalists, but once you start boiling down things to need vs. want, the amount of stuff you really need is very small. Once you reduce those expenses, travel finance becomes a measure of where to put the excess money.

Budget, Budget, BUDGET!

Both on a trip and when you are home, make a budget and stick with it. It is ok to blow a category every now and then, but you have to stick to the overall budget.

This is where a lot of folks get into trouble. They get wrapped up in the experience of traveling and it hurts them in the long run when they don’t pay attention to the price tag.

When finances get tight, it’s not fun. It might mean saying no to dinner out, new shoes or a pedicure. But, that is what it sometimes takes.

Your First Task: Merge and Communicate

Merge your finances or somehow create joint finances with your spouse. I know, I know. There are many folks out there who simply cannot work together with their spouse on money. At the very least, you need to create joint finances with your spouse to truly make a budget work. If you do this, you will both be able to look at the “big picture” of your finances every month.

Bonnie and I sit down together every month to pay bills. It is one way we make sure we both know what is going on and, for us, it reduces arguing about money considerably. Communication is key for travel finance (and a healthy relationship)! I cannot stress this step enough!

Second Task: Get Online

Sign up for online banking for everything. If you are not using online banking, traveling for extended periods of time is simply not feasible. You still need to pay your bills at home, even if you are not there (more on that later). Online banking allows you to pay your bills from anywhere in the world, provided you have access to the Internet.

Third Task: Categorize

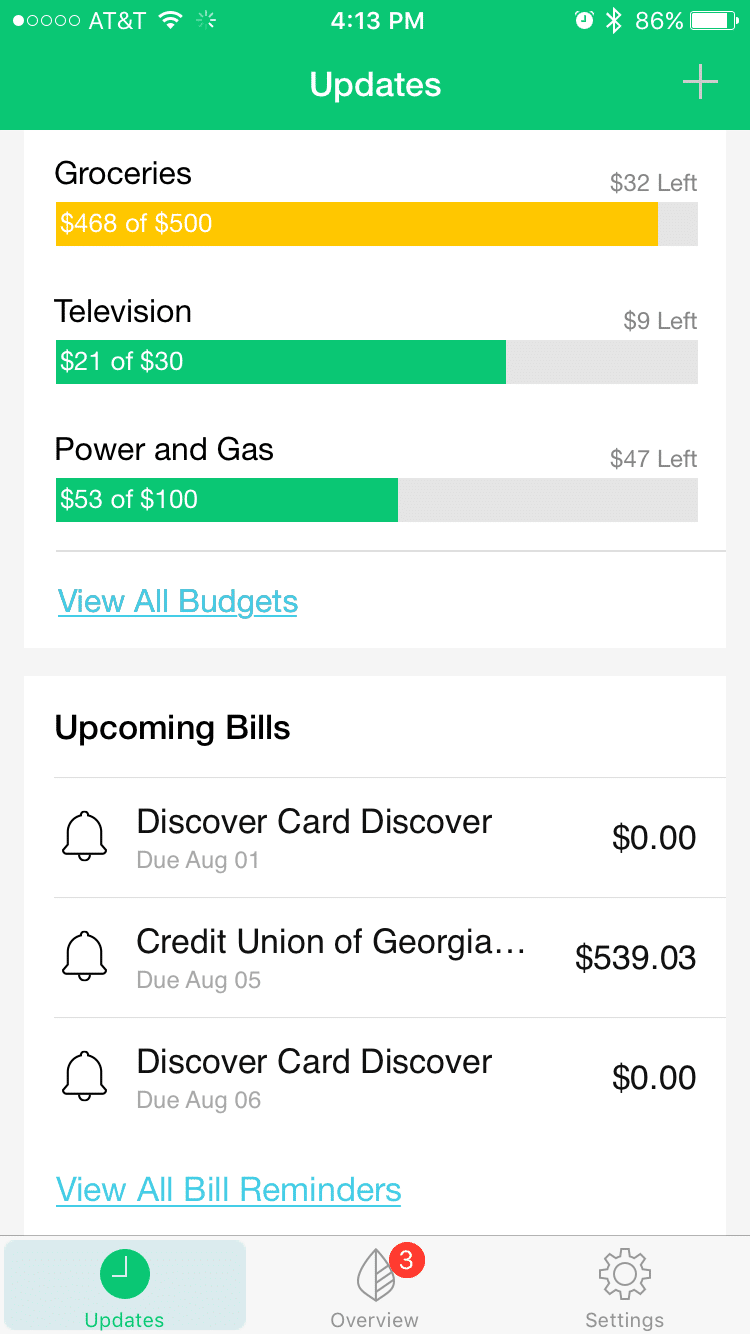

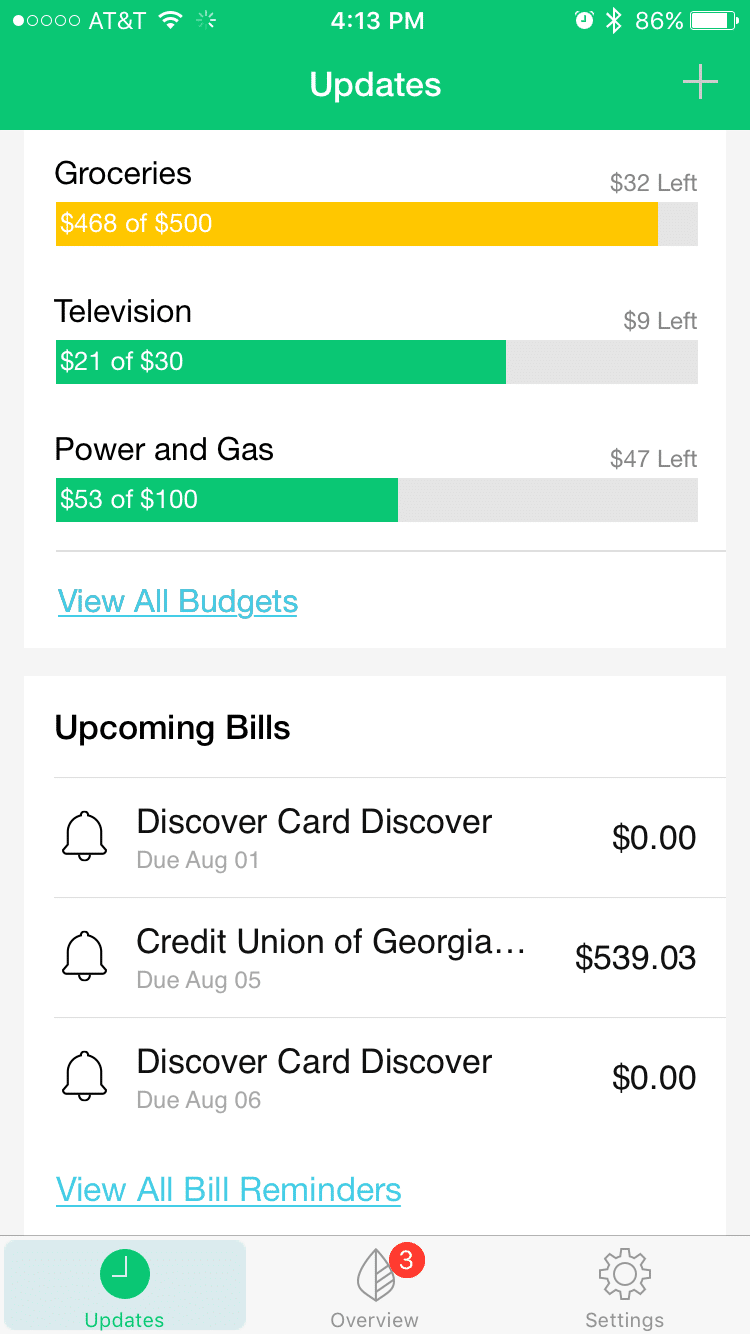

Get Mint.com or another online budgeting program. We have been using Mint for years and generally like it. Here’s the deal: Mint logs into your online banks and downloads all the transaction data and categorizes the transactions. Once the transactions are in Mint, you can fine tune their categorization to make sure they are correct.

Mint also has apps for just about every kind of device. You can get the iOS app here. One handy feature of Mint is it allows both of us to see what is going on money-wise all month-long, again reducing arguments about money between us.

I understand some of you may be reluctant to have so much of your finances online. Mint is owned by Intuit, the same folks who own TurboTax, meaning you can trust the security. We have been using Mint for MANY years and have never had a single problem.

Fourth Task: Budget

Once you have categorized everything, it is time to create some budgets. For example, I can look back at how much we have paid for electricity for the past few years since we moved in and know we rarely pay more than $100 per month, so I budget that much for electricity. Rinse, lather and repeat for all of your consistent monthly expenses.

Be sure to do this step. This becomes incredibly important later where we will talk about using credit cards to maximize your travel.

Save!

Now, it is time to do some budgeting for the incidental expenses, like eating out, shopping, etc.

We typically budget eating out as its own category, but we also set a budget for Everything Else. By doing that, you catch all of the little transactions and things that don’t easily fit into other categories.

Once you have figured out what to budget for everything, and you have some leftover money in the budget, it is time to start saving! Note: we are not extreme savers. Meaning, we do not personally set severe limits on the “fun stuff” such as eating out. We set reasonable budgets that allow us to enjoy life and save for travel and other necessities.

You can also do this the other way around: set the amount you want to save, then divide up the leftover for your incidental expenses. Whichever way you approach this, you need to find the right balance between spending and saving for you.

We use Capital One 360 Savings for our travel savings and other categorized savings. We keep our “emergency savings” in American Express Personal Savings, which has a higher interest rate, but less flexibility.

What makes the Capital One 360 Savings so nice for us is the ease of creating multiple accounts. You can set up several accounts for saving amounts in different “buckets.” We keep separate accounts for saving for travel, stuff for the house and our holiday funds.

The holiday fund is where we stash money for birthday and Christmas presents for our family. That account is really valuable in June when we have my niece’s, Bonnie’s dad’s, my dad’s and my stepdad’s birthdays PLUS Father’s Day all within a week of each other.

Sticking aside money for travel, even when you don’t have a trip in mind, makes it a lot easier to take advantage of really good bargains when they come along.

What’s next? I know this is kinda like telling someone who wants to lose weight to cut calories and exercise, but if you follow these steps, you can afford to travel, too!

Travel Finance 102 – Travel Loyalty Programs

These have been around for decades. There are entire Web sites dedicated to discussing the pros and cons of travel loyalty programs. Flyer Talk and Inside Flyer are two great resources for information on the perks of the various programs.

There are also bloggers, like The Points Guy, whom we follow, which are dedicated to maximizing the accrual of points and miles for the various programs.

Let’s break it down simply: these programs reward loyalty with some sort of currency (miles or points) which can be used for free hotel stays, airline tickets, etc. They also typically have different levels and reward the folks who use their services more often with perks, like free Wi-Fi in a hotel or complimentary upgrades on airline seats. Just about every major travel brand has a program and some are better than others.

Hotel Travel Loyalty Programs

Let’s talk hotels for just a moment. There are several major hotel companies out there, each with several brands and levels. At this point, it is time to decide which hotels you stay at most often.

Why We Like Hilton

For us, it is Hilton properties and the Hilton Honors program. We know we can generally find at least a Hampton Inn just about anywhere we go in the US. That said, we are also members of Best Western Rewards and Choice Privileges as backups for some of the very small towns we have stayed in.

Here is why we like the Honors program: We are Gold members, the second-highest tier. We maintain that level through a premium credit card (more on that in part three). At that tier, we get complimentary (if rare) upgrades to available better rooms. We also get free breakfast at most of the hotels. Hilton Garden Inn (where we stay if available) cooks a hot breakfast, to order. The value of the breakfast varies but is typically a $10 to $12 per person perk. Additionally, we get complimentary Wi-Fi, although, with recent downgrades to the Wi-Fi speed, this is less of a perk.

Those are just perks of the stay. There are additional perks, including receiving a fifth night free on any rewards booking on a standard room, digital check-in (handy because you can choose exactly which room you want), late check-out, complimentary access to fitness centers at some of the higher-end hotels which charge and, most importantly, a 80% bonus on Hilton Honors points earned at a paid stay. That may not seem like a huge perk, but it means we get free stays that much faster.

Other Hotel Travel Loyalty Programs We Use

Why then, do we also maintain membership in Best Western Rewards and Choice Privileges? Primarily, so we earn some kind of rewards for when we need to stay in an out of the way place, like Pagosa Springs, CO or Cody, WY which don’t have Hilton properties. Also, while Best Westerns are not always the best in the U.S., they are easily found all over Europe and are typically quite good there.

While we like Hilton, Marriott and Wyndham are very comparable and have a wide range of brands as well. There are IHG hotels all over, but IHG does not have higher-end brands. Hyatt and Starwood have nice hotels but are not in every small town. Typically, your best bet is to pick one of the major chains which suit your travel needs and stick with it so that you are accumulating the majority of your points in one program.

Airline Travel Loyalty Programs

Airline programs are a bit of a different animal these days. If you fly for work often or travel internationally a lot, pick a program (or airline alliance) and stick with it. You will be able to rack up status quickly and that can have significant advantages for you, including complimentary upgrades to business class.

Like the hotels, different airlines offer different benefits and it all really depends on what program works best for you and your travel plans. One recommendation: if you live in the Pacific Northwest, you should take a look at Alaska Airlines. Points experts regard Alaska as the Switzerland of airlines, partnering with 16 different airlines like American, Delta and British Airways.

For Bonnie and I, loyalty to one airline won’t get us any kind of status. We simply don’t fly enough. My recommendation for folks like us who do not fly more than once or twice a year: become members of all the programs, but shop the sales and pick your flights based upon price, not upon which airline you have “loyalty” to.

What Happened to Delta?

Bonnie and I used to be big Delta fans. Atlanta, where we live, is the headquarters of Delta. Hartsfield-Jackson International Airport is about 50% Delta flights. Sounds great, right? Part of our travel finance plan was the Platinum Delta American Express ($195 annual fee, but got a companion ticket) and did all of our flying on Delta. We used SkyMiles to upgrade our flights from Atlanta to Seattle to business class for our honeymoon. We used SkyMiles to purchase our business class tickets to Rome.

Our companion ticket was used a couple of times, generally getting about $100 in value more than what we paid in the annual fee. But using the companion ticket is complicated and requires you to purchase certain classes of fares to take advantage of it.

Eventually, when it came time to use miles, we found an increasingly more and more strict rewards program for flights. Then came our flight to Prague.

The Eastern Europe Boondoggle

Delta gave us $900 each in vouchers for getting bumped twice on a trip to Sarasota, Fla. for a wedding. We decided to fly to Prague and went to book the flight using the vouchers and to use miles to pay for the remainder. Nope…against the rules. Thought about getting an upgradeable flight to Prague (which are generally more expensive than a normal flight), so we could use miles to upgrade our flights. We could, but it would cost $2,000 more to buy upgradeable tickets than to just buy business class tickets. Yes, you read that correctly. It would have cost more money to use SkyMiles to upgrade to business class than to just buy a business class ticket.

Then there was the whole flying back to Prague business. So, we had a flight from Dubrovnik to Prague, but the budget European airline just decided to stop flying the route. That left us looking for another flight. We figured out it would cost just as much to fly back to Prague as it would flying to Amsterdam, where our flight connected for a flight to Atlanta. So, I called Delta and explained the deal… All we wanted to do was get on the plane in Amsterdam instead of Prague. Delta wanted to charge us $400 each to NOT fly from Prague to Amsterdam. I know that is not just a Delta thing, but still… It reflects the death of common sense.

So, we ditched the SkyMiles Amex for a Blue Cash Everyday Amex, which has no annual fee and gives 1% cashback on all transactions, 2% on gas (nice for road tripping!) and 3% on groceries. We have since replaced that card but you get the idea.

The Bottom Line on Travel Loyalty Programs

Most loyalty programs are free to join and offer rewards. For hotels, picking one that has properties in a good variety of locations will benefit you the most. For airlines, unless you travel by air a lot, you are best served by joining all of them. Then shop the sales rather than staying loyal to one particular airline.

Ready to really make those loyalty programs work for you? Time to check out part three on credit cards.

Travel Finance 103 – Making Credit Cards Work for You

Once you have joined the mileage programs you are interested in, now it is time to sign up for credit cards. Yes, this is an essential component (for several reasons) to your travel finance plan and here’s why:

- The credit cards we recommend earn rewards on your everyday transactions. This is HUGE! Basically, the credit cards are giving you currency for travel just for using their product, on purchases you would be making anyway.

- Credit cards add a layer of protection against fraud for your money. If there is one major piece of advice you should take from this article, it is this: you should NEVER, EVER use a debit card for any transaction, EVER, other than as an ATM card. Debit cards are linked to your checking account and, while yes, the bank will make it right, how long is that going to take? How many transactions will be denied in the process? Your money only touches the credit card account once a month, when you pay the bill. The bill is wrong? You contest the charges and the credit card company takes care of the rest.

- A good travel card will have complimentary rental car insurance, trip cancellation and purchase protection, all of which is worthless if you don’t use the card to book the travel, etc.

- A better exchange rate. Credit card companies and banks can negotiate a better exchange rate than you can with cash. This will save you money in the long run, even if there are a few transactions where you could have done better.

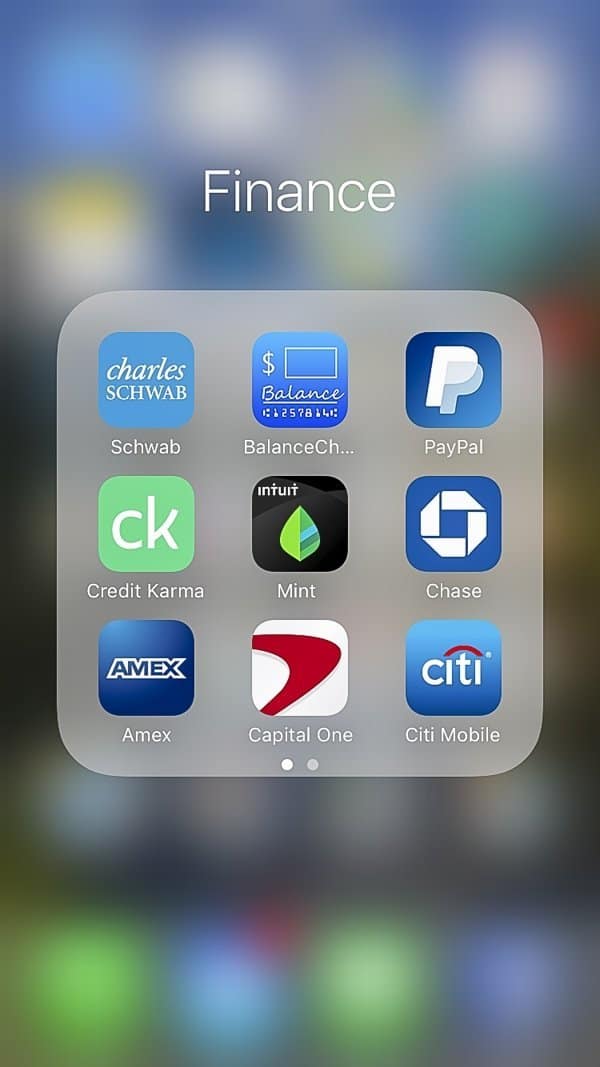

First and foremost, arm yourself with free knowledge: download the app and sign up for Credit Karma. Credit Karma is a free credit monitoring service. It gives you pretty good details, including credit scores, from both TransUnion and Equifax, two of the three credit bureaus.

Note: we know that some of you may be fundamentally against using credit cards. If you have had problems with credit card debt in the past, you can skip this step. You just won’t earn as many rewards. But, please, stick to cash, not a debit card!

If you are using credit cards, you must follow our Number 1 Rule: NEVER CARRY A BALANCE!!

Picking Credit Cards

Now, it is time to pick a few travel cards. I recommend you have at least three credit cards: two Visa cards and one American Express card.

Here’s why: the two Visa cards will be your “go-to” and your “back-up” cards when you travel overseas. If one has an issue, you simply take out the other card, complete the transaction and move on. We had this happen in Siena, Italy. Citi declined my Hilton Honors Reserve card at a restaurant. I simply pulled out my Capital One VentureOne card and moved on. I called Citi the next day, via Skype, and resolved the issue with minimal fuss.

American Express is great domestically and has amazing customer service, as well as great benefits.

Here is what you should look for in a travel credit card:

- No foreign transaction fees. Most cards charge 3% for using your credit card overseas. You don’t want that.

- Primary Auto Rental Insurance. This is a huge benefit, meaning you can decline the coverage by the rental company. Your credit card has it covered.

- At least an effective 2% cashback equivalent reward rate for using the card. That will all depend on how the points, miles, etc. are valued, but 2% is the bare minimum you should consider.

- A good sign-up bonus. This is a great way to get a boost on your point earning.

- A low or no annual fee. If there is an annual fee, make sure it is balanced in some way by yearly rewards.

Read more about choosing the right travel credit card here.

The Cards in Our Wallet

We keep four different credit cards in our wallet: the Hilton Honors Ascend American Express, the Chase Sapphire Reserve, the Chase Freedom Card and the Chase Ink Business Cash. Plus we keep the Citi Double Cash Card at home. Each one serves a different purpose.

Here is what we like and don’t like about each card:

•American Express recently bought out Citi’s portfolio of Hilton Honors-branded credit cards and created several new cards, including the Hilton Honors Ascend American Express.

This new card is a good combination of the benefits of the original Hilton Honors American Express cards and the Citi Hilton Honors Reserve Card. The card gets a whopping 12 points on the dollar at Hilton Properties (6% cash back equivalent), 6 points on the dollar (3%) at restaurants, grocery stores and gas stations, and three points (1.5%) on everything else.

The best perk of this card is the automatic Gold status with Hilton Honors. You can easily make up the $95 annual fee just enjoying free breakfasts at Hilton Garden Inns. You can get to Diamond status with a $40,000 spend in one year, something we have enjoyed for the past year.

The card also retains the free weekend night, but requires a $15,000 spend, a 50% increase over the old Citi Hilton Honors Reserve. This is a great benefit and well worth planning your spend to achieve every year.

Read about taking advantage of a Hilton free night certificate here.

Additionally, the card has no foreign transaction fees, a rarity for American Express. The signup bonus for this card is presently 100,000 Hilton Honors points with a $3,000 spend.

We use this card for purchases at Hilton properties, gas, groceries and all other purchases which don’t match another category.

Chase Ultimate Rewards Cards

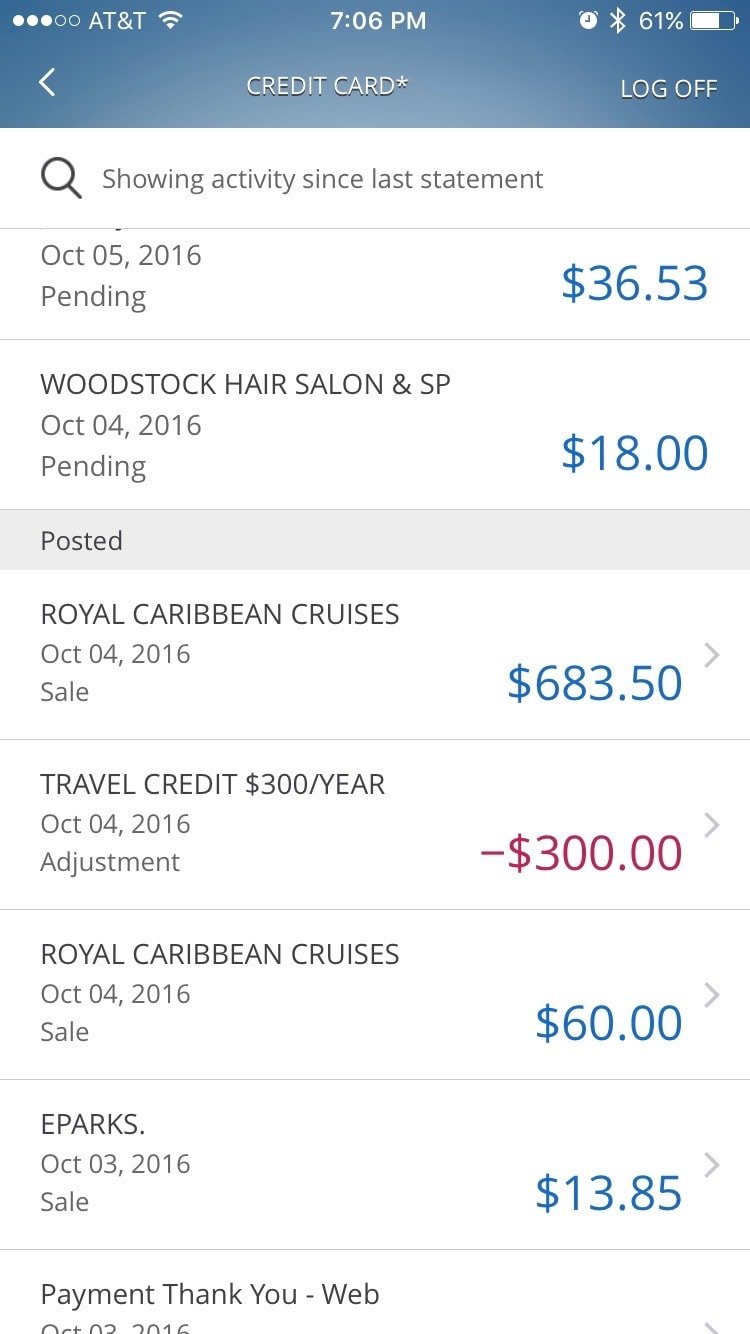

•The Chase Sapphire Reserve card is a bit legendary now. When Chase first issued the card, it had a staggering 100,000 Ultimate Rewards points sign-up bonus. Chase has since lowered the bonus to 50,000.

The card also changed the valuation of Chase Ultimate Rewards Points for Sapphire Reserve cardholders.

Typically, when used as cash on a travel purchase, rather than transferring 1:1 to a travel partner for their points, Chase Ultimate Rewards Points are worth 1 cent per point.

For Sapphire Reserve cardholders, they are worth 1.5 cents per point. That means the sign-up bonus alone is worth at least $1,500 in travel credits, which is pretty staggering.

It has a mighty expensive $450 annual fee. I am not generally a fan of annual fees and that’s a lot of money! But, you get a lot for your money: a $300 travel credit per the calendar year (we have already gotten that perk twice, in only six months!), which brings the effective annual fee down to $150.

You also get Priority Pass Select Lounge access at airports (be sure to call to get that activated!) and a credit every five years for Global Entry or TSA PreCheck. That alone is worth the $450 fee.

Add in primary auto rental insurance in the US, and this is an outstanding travel card.

The card gets 3 points per dollar on dining and travel expenses and 1 point on everything else. Chase Ultimate Rewards Points are worth between 1.5 and 2.1 cents each, so the effective cashback on travel and dining purchases is between 4.5% and 6.2%.

We use this card for all travel and dining purchases.

•The Chase Ink Business Cash card is a business credit card for the blog. The card had a 30,000 point sign-up bonus after a $3,000 spend and gets 5 points per dollar at office supply stores, cell phone, landline, internet and TV services (including Netflix and Hulu) (a minimum of 7.5% cashback) and 2 points per dollar on gas (4% cashback).

We use this card for all blog purchases which don’t fit another category. We have our Internet and TV services set to auto-pay on this card and we also use this card for gas.

•The Chase Freedom card is our final card in the mix.

The Chase Freedom has a rotating quarterly category for 5 points per dollar, which at a minimum is worth 7.5% and, if spent well, can net 10.5% cashback.

Chase sent us this card in December and we knocked out the $500 spend for the 15,000 point bonus by purchasing tires at Sam’s Club for the truck… at 5 points on the dollar since the quarterly bonus was warehouse stores. We also got an extra 2,500 points for adding Bonnie as a cardholder.

We use this card for whatever the quarterly category is.

Citi Premier Card

The newest addition to our collection of cards is the Citi Premier Card. We got this card for a few reasons: 1) We realized that all of our rewards cards were in my name with Bonnie as the secondary cardholder and we wanted to change that, 2) We wanted to diversify our points from just Chase Ultimate Rewards Points, and 3) We didn’t feel we were getting our money’s worth out of the fee for the additional cardholder for the Chase Sapphire Reserve.

We chose this card because the categories for earning points were complementary to what Bonnie was losing by not carrying the Chase Sapphire Reserve and it only has a $95 annual fee. We got a 60,000-point signup bonus after a $4,000 spend.

City ThankYou Points are worth 1.7 cents per point and the program has 15 airline partners. You can use the points as straight travel credit, earning 1.25 cents per point. The card earns 3 points on travel INCLUDING gas, which amounts to 5.1% cashback on travel and gas purchases. This will easily be our go-to card for gas in the future.

That means the signup bonus is worth about $1,000!

The card also earns 2 points on restaurants and entertainment (3.4%), which is not quite as good as the Chase Sapphire Reserve for restaurants but adds entertainment, which we didn’t have a card for.

My biggest grumble with this card is Citi just got rid of some of its best features, like Price Rewind.

We use this card for gas and any dining or travel purchases Bonnie makes.

Cards We Keep, but not in Our Wallet

•The Capital One VentureOne card gets 1.25% cashback in the form of miles that can be used for travel expenses. There is no annual fee, no foreign transaction fees, a one-time bonus of 20,000 miles. We use it as our back up card while traveling overseas and that is what I recommend. That is the reason it is not pictured above because we do not use it regularly in the US. There is a version that earns 2% cashback but that one has an annual fee.

•The Chase Amazon Rewards Visa gives 5% cashback on Amazon purchases if you have Prime, 2% at gas stations, restaurants and pharmacies and 1% on everything else. There is no annual fee, the sign-up bonus was $70 at Amazon. The card got rid of the foreign transaction fee, but we only use this card for Amazon purchases.

•The Apple Card is the newest thing in the credit card world. It gets 3% back on Apple purchases, 2% on purchases using Apple Pay and 1% if you use the physical (titanium!) credit card. Since I have a few regular charges to iTunes and use Apple gear extensively, I got this card. That said, I won’t carry the physical card, only use it the Wallet app on my iPhone.

How to Use Your Credit Cards

First and foremost, remember in part one when I spoke about using Mint? Yeah, this is where it becomes essential. In order to make these credit cards work, you must follow this one infallible rule: NEVER CARRY A BALANCE! Yes, we said this earlier…it is so important, we are saying it again!

Seriously, all the rewards in the world cannot make up for the interest charges you will get if you do not pay off your credit card every month.

That’s why you use Mint. Mint will track those credit card purchases and categorize them into budgets.

Once you have that squared away, it is time to use your credit cards. The second infallible rule: EVERYTHING GOES ON THE CARD. Seriously, everything. Never pay cash for anything. You lose money every time you pay cash. The only time you should pay cash is if there is a surcharge and even then you should weigh the options. If you stand to earn 2% effectively and the merchant is charging 1.5%, you are still coming out ahead.

One thing you should do right off the bat for your cards: get the apps on your smartphone for each credit card you have. This will come in handy below where we talk about paying bills.

The other thing you should do is set up your cards in either Android Pay, Samsung Pay or Apple Pay, depending on your cell phone and use that as much as possible. Why? Because it is far more secure than even using a chip. By using either service, it transmits a one-time credit card number (not your actual number) through the payment terminal. By using that, you do not have to worry about corporate financial records compromising your credit information.

Finally, no matter what credit cards you have, you should make a point every year to put at least one transaction on them to keep the accounts open. Citi closed our Honors Signature Visa due to inactivity… The Reserve Visa was so much better, why would I use it? To keep the credit line open, it turns out, because losing the card dinged my credit report. If you add all of your cards into Apple Pay, you can use the odd card once a year without putting it into your actual wallet.

Now, some folks do a process called “churning.” Churning is signing up for, then canceling later, rewards credit cards to take advantage of the sign-up bonuses. We can’t really speak to that except to say don’t try it until you have done your homework on it. I suggest hitting The Points Guy or Flyer Talk for more information on churning.

Ok, now you have your credit cards squared away and ready to go.

Travel Finance 104 – Finances on the Road

Ok, so you followed my advice from the first three parts: getting your finances ready, mileage programs and credit cards. You ’re ready to get out on the road and travel, right? Ready to be able to pay bills while you are on the other side of the world?

Hold your horses. We need to do a little groundwork to make sure you can take care of everything on the road.

Step 1: Pay Bills by Credit Card

Make sure you use credit cards to pay all of your bills. Be sure to make sure you are maximizing your categories first, but it is ok to bill some of your charges to cards you want to keep open, but don’t want to do the majority of your spend.

This step is important for two reasons: 1) Remember in the last part where I said to put everything on the card to maximize your credit card rewards? Yeah, this is part of the deal. 2) This cuts down on the number of bills you have to pay at the end of the month. You are on the road to travel, right? So, maximize the time you are spending enjoying your travels and not worrying about bills.

The only bills we don’t use a credit card for are our mortgage, car payment, RV payment, condo fees, electric bill and water bill. Everything else goes on the card. If I could find a way to put those bills on a card without paying a fee, I would in a heartbeat.

Step 2: Download and Set Up Financial Apps

Make sure you have set up your financial providers’ apps before you leave. Preload your checking account information into all of the bill pay apps. Again, this will save you time while on vacation. Make sure you have the app for your checking account loaded as well and that it supports paying bills online.

Step 3: Set Up Online Bill Pay with Your Checking Account

If you haven’t already, set up an automatic online bill pay with your checking account for the transactions you can’t charge to your credit card without paying a fee. Balance My Checkbook (see below) will allow you to set up recurring transactions, like a mortgage or auto payment. This allows you to pay things easily while on the road. Need to send a check? No worries, your bank will send one for you!

Make sure you set up any bill which is the same every month as an automatic payment. Again, all about saving you time on the road.

Step 4: Keep a Checkbook (or App)

Keep a checkbook (or checkbook app) and make sure you reconcile it before you start paying bills. I use Balance My Checkbook. I used to use iXpenseIt, but they made significant changes to the app making it all but unusable for what I wanted to do with it. It’s not a bad app, just not good for what I use it for.

When I first started using Balance My Checkbook, I didn’t like it. Now, after using it for several months, I like it a lot better. It is easier to balance the checkbook to the penny with this app, which is nice.

Note: this is different from using Mint to keep track of your budgets. All I use Balance my Checkbook for is keeping track of how much cash I should have in my checking account.

Now, you are ready to hit the road. But you still have to keep on top of things while you are traveling, lest you overspend.

Step 5: Check Your Transactions in Mint

Make sure you are checking your transactions as you travel in Mint and categorize them properly at least every other night. This also serves the purpose of monitoring for fraudulent transactions. I suggest creating budget categories for each major expense while you are on a trip. You will be able to easily break down how much you spent on which category in a year.

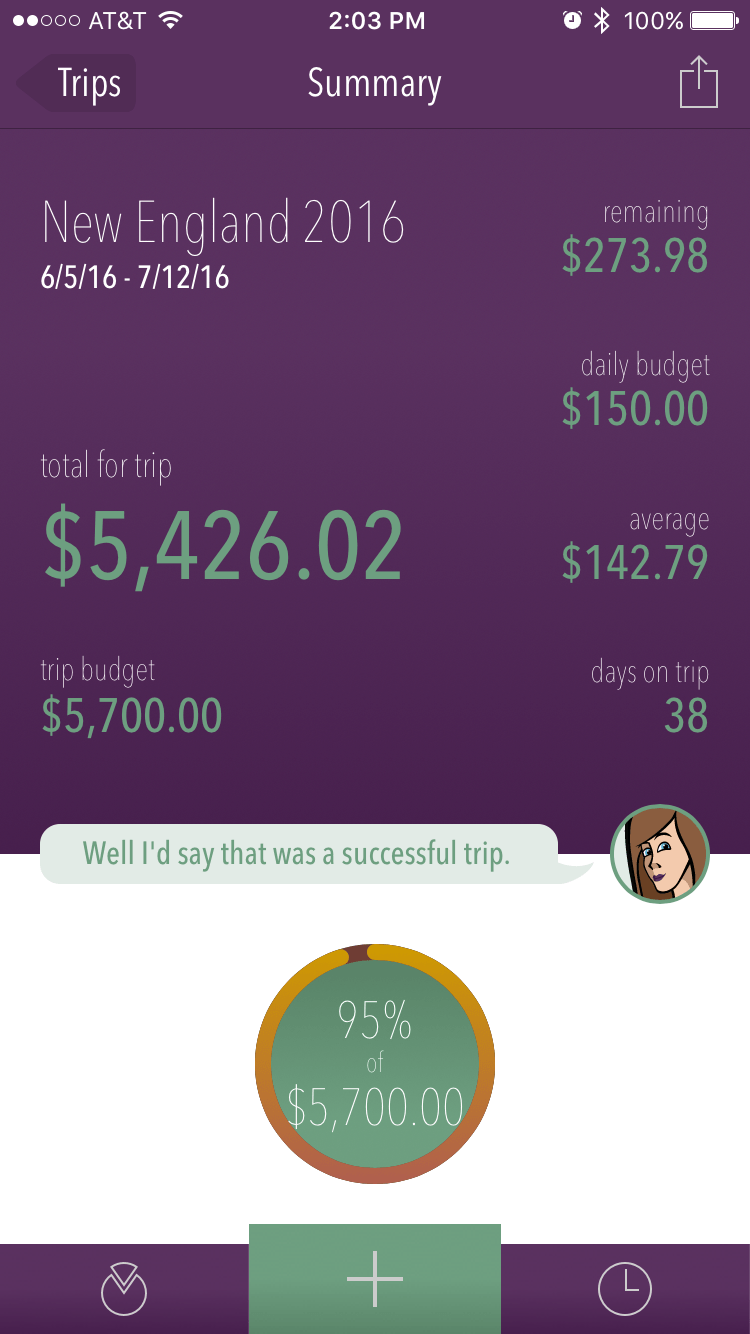

Step 6: Set a Trip Budget and Stick With It!

Set a budget you can afford (either daily or overall) and use Trail Wallet to stick with it. Record every transaction, even if you use cash (sometimes you have to!), and record it in Trail Wallet.

I know some of you are asking: “Why should I use both Mint and Trail Wallet to record transactions?” The answer is cash. Particularly in less-developed nations, cash is king. But all Mint does is categorize that you have withdrawn money via the ATM, not what you spent it on. Always use credit cards when you can, but when cash is called for, Trail Wallet helps you keep track of it!

Together, Trail Wallet and Mint will help you stick to your budget, which is just as important on the road as it is at home!

Step 7: Plan Time to Pay Bills

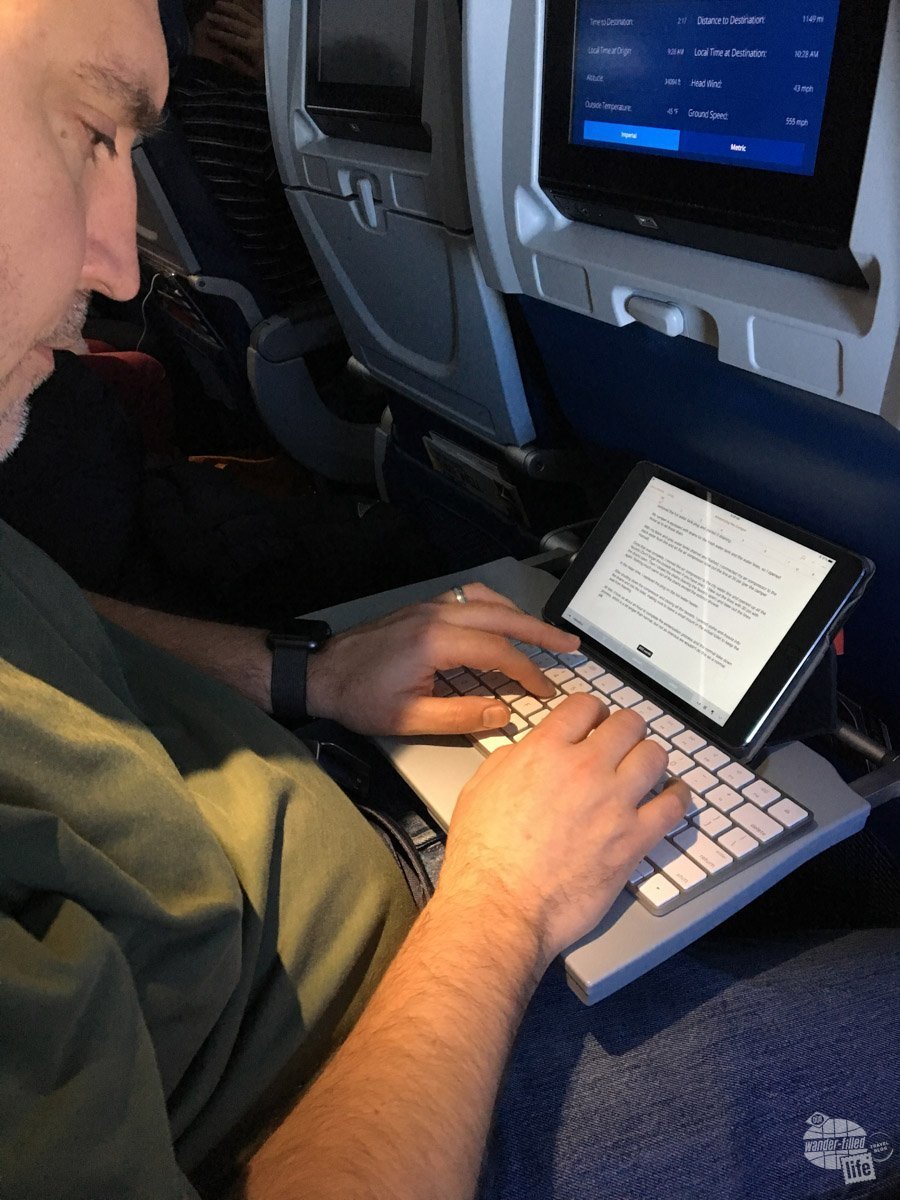

Set a day (or two) aside to pay bills. For us, this is around the first of the month, because that is when we get paid and most of our bills are due. For some folks who get paid twice a month, this might be a twice a month process. In your travel plans, this should be a consideration.

Make sure wherever you are paying bills has a good cell phone signal. This part is important: Always pay your bills via cell phone signal vs. public Wi-Fi. I would not trust campground Wi-Fi either. I am typically ok with good hotel Wi-Fi, like a Hilton property, but otherwise, use your cellular data. We had our iTunes password intercepted at a campground Wi-Fi in Key West. It wasn’t a big deal, but, still, I would rather not deal with that again and I especially do not want financial passwords floating about a public Wi-Fi system.

Alternatively, get a good VPN (a virtual private network) for using public WiFi. We use NordVPN and it works really well.

Step 8: You Gotta Pay Bills!

At this point, it should be relatively easy. All you should need to do is set up payments for your credit cards and any utilities that can’t be paid by credit card. For us, it is our power bill at the beginning of the month and the water bill which arrives at some point towards the end of the month.

If you are traveling with your spouse/partner/whatever and are doing joint finances, I can’t suggest highly enough sitting down together to pay bills. I know I mentioned it in part one, but I can’t say it enough.

One of the most important lessons I learned from the book The Mission, The Men and Me by Pete Blaber: “It is not reality unless it is shared.” Sharing the reality of finances with your partner makes you a team for the trip, financially. You are working together, as opposed to one partner always telling the other, “No, we can’t afford this.”

The other good part about two people paying bills together is Bonnie handles making the payments, while I update the checking app as she pays them. At the very least, having two devices to handle both aspects of the transactions is very helpful.

I know some of these may seem like common sense, but I am always surprised at how many folks don’t realize how easy it is to manage your finances from 5,000 miles away using nothing more than a smartphone and a little bit of planning ahead.

Now, I will discuss how to take all of this and turn it into an amazing AND affordable trip.

Travel Finance 105 – The Trip Finance Equation

Now, it is time to learn how to make the most of your accumulated resources and book your trip without breaking the bank.

A Great Vacation = Time + Currency + Desire

The Trip Finance Equation, Grant Sinclair

The Three-Sided Travel Finance Equation

Booking a trip is an equation with three variables: time, currency and desire. In order to truly enjoy the trip and not break the bank, those three things must be in balance.

Travel Finance Variable #1: Time

Let’s talk about the first variable: time. I can tell you how much I enjoy our month-long summer trips and how awesome it was to spend a month in Italy really getting to know the country. It doesn’t mean anything to you unless you can take that much time off and who really can?

I am able to because I am a teacher and school is not in session, however, for most folks, taking more than a week off at any one time could place their job in jeopardy.

The first piece of advice: When traveling for a limited amount of time, pick one area and stay there.

Your time is valuable… Don’t spend it hopping around from place to place, which is also expensive in terms of currency, too.

Let’s say you have always wanted to go to Europe, but you only have a week. If you are anything like us, you have a list of things you want to see a mile long in Europe. Add in the cost of airfare, and you are probably looking to find a way to see everything. Don’t! Don’t feel you have to see everything.

Pick a region, an area, and really dig in. You will find there is a lot more to a country than just the “touristy” things if you spend more time there… Or you might find, like we did in Slovenia, that you wish you had spent more time there to really enjoy the country.

Time, Part 2: Flexibility

The other thing to make sure you are doing is building in time for you to be flexible in your travels. For example: if you read in a guide a particular city should take at least three days, building in a fourth day will allow you to explore some off-the-beaten-path attractions and stay rested.

Being flexible will also allow you to handle inclement weather or if you’re feeling under the weather.

Another good aspect of being flexible in your timing is the ability to take advantage of travel delays. Bonnie and I always volunteer to be bumped off a flight if we can manage it, time-wise. We have taken some amazing trips much, much cheaper by taking airline vouchers in exchange for spending a few extra hours in the airport.

Indeed, Bonnie and I once flew to Philadelphia for the Army-Navy Game on a companion ticket from our SkyMiles American Express. On the way back, we volunteered to get bumped. We used the vouchers we got to fly the following April for a long weekend in Arizona. A Hilton resort provided accommodations, and we used free night certificates from our Hilton Honors Reserve Visa card. We just paid for food and a rental car while we were there.

Travel Finance Variable #2: Currency

Note, I did not say money. There is a reason for that. Currency also includes your frequent traveler rewards points and credit card points.

The first thing you need to establish is the value of your points, miles, etc. Check out The Points Guy for how you should value your points. That will give you a good litmus test as to whether a point reward is better or worse than just paying cash.

When are Points Better than Cash?

For example, Hilton Honors points are pretty consistently valued at 0.5 cents per point. That means 10,000 points equals $50 in cash. So, that means our reservation at the Hilton Savannah DeSoto for 40,000 points means we spent the equivalent of $200 for a room that would cost us $209 plus taxes, meaning we came out ahead in terms of using points.

One of our favorite hotels for a stop on the way out West is the Hampton Inn in Clarksville, AR. It is right off I-40, about a 10-hour drive from Atlanta. The hotel is very comfortable and it only runs 10,000 points per night, which is a steal considering its $149 rate. It used to only be 5,000 points, but even with the bump in cost, it is still a great value.

The flip side of that equation is when you find a room that is a reasonable price, but not a good value, point-wise. That’s what your travel rewards credit card is for! I get a whopping 12 Hilton Honors Points per dollar spent on a Hilton property with my card, which translates to 6% cashback. Add in the fact that I get 18 points on every dollar I spend at a Hilton property just for staying there (in addition to the credit card spend) and my effective cashback rate on staying at a Hilton property is 15%.

The second piece of advice: as you are planning your trip, look at your options in all of your available currencies.

Sometimes, it can be worth it to drive a bit out of your way in order to take advantage of a bargain, but again, that has to be balanced against your available time.

One of the best ways to find a cheap place to go is Google Flights. I can’t tell you how much I am looking forward to making better use of Google Flights now that we have divorced ourselves from Delta for domestic flights (that’s not to say I won’t fly Delta anymore, just they have lost my loyalty).

Google Flights is telling me I could easily fly to Denver for $142 on Frontier Airlines, versus $322 for Delta, and Spirit Airlines is flying to Boston right now for $197.

Another great option is Skyscanner. We have recently started using this tool to make flights happen.

The third piece of advice: it is not just how much it costs to fly somewhere, but also how much it will cost to “live” somewhere.

We had vouchers for airfare back in 2015, but we weren’t sure where we would go. First, we looked at Hawaii, but the cost of living there was more than we could manage. We ended up going to Eastern Europe for a week longer and spent less money in the process. Indeed, we spent just over $200 per day for both of us traveling throughout five countries.

Travel Finance Variable #3: Desire

For us, the best part of travel is seeing places we have never been before, but even so, you have to want to go there, which brings me to the last part of the equation.

I will level with you. I have no desire to travel back to Kansas, other than to visit my dear friend James who lives there. Don’t get me wrong, we have enjoyed the time we have spent in Kansas seeing various national parks sites. Indeed, Tallgrass Prairie National Preserve and the Flint Hills are nice. But we have driven a lot through that state and have no real desire to go back.

So, Frontier’s $206 airfare to Kansas City is not worth my money or my time, deal that it is.

The fourth piece of advice: make a list of places you want to go to. Don’t prioritize the list, but do add when the best times, weather-wise, to visit are.

From there, develop a list of places you would like to go during each season. Now, when you find a sale on airfare, you can take advantage of a bargain to someplace you WANT to go.

Desire, Part 2: Don’t Go Just Because “Everyone” Says You Should

One more confession: I have been to a lot of places, but none that I dislike more than Naples, Italy.

But, I have read numerous recommendations to go there, if nothing else, for the pizza. One, we had better pizza in Rome and, two, that’s not enough for me to want to spend time there, but it was a “must visit,” so we went.

We also went to Milan, because it was a “must visit.” We found the city, other than the main square, to be devoid of charm. The main square took us about an hour to visit, but the overall visit took a day and a half… which would have been better spent up in the Alps or along Lake Como.

Whenever anyone, including us, says it is a “must visit,” take a hard look at why and determine if that is your thing. After spending two separate months in Italy and Eastern Europe, Bonnie and I are quite ok not going to a small town in the middle of nowhere to see a “must-see” church. We have seen a lot of those, from the Vatican in Rome to the Ossuary in Kutna Hora, Czech Republic. We don’t need to make a special trip to see another one unless there is a lot more to the place than just a unique church.

It’s not a bargain if your time, your currency and your desire don’t balance out. Sure, there are times to get out there and try something new, experience something you wouldn’t have otherwise tried and to just give it a shot. But only if the other parts of the equation balance out for you.

That’s the real secret to finding a travel bargain… Is it a bargain based on your desire, your time and your currency?

The Bottom Line

Travel finance is a tough nut to crack when you are just starting out. It takes planning and work. In the end, you are creating a system that perpetually finances travel. It also allows you to travel for long periods of time while keeping a tight watch on your bills.

Since credit cards and bank accounts change constantly, I will be updating this guide. If you have any questions or feel my information is out of date, please let me know!

Travel Resources

What do you use to find a flight?

We use Skyscanner to find deals on flights. Skyscanner has a great interface and compares tons of airlines for the best pricing and routing. That said, it does not always have every airline and some airlines will have better deals on their website. Still, Skyscanner is a great place to start.

Click here to search for a flight.

What do you use to find a hotel?

We typically stay at Hilton properties, so we use the Hilton website. You can find good Hilton Honors discounts or AAA discounts for a hotel there. We make great use of our free night certificates from our Hilton Honors American Express.

Click here to book a Hilton property.

If there are no Hilton properties available, we use TripAdvisor to read reviews and book the hotel. We find we can get the best price that way.

Click here to search for a hotel.

We recently partnered with Stay22 to add interactive maps to each of our destination posts. This will allow you to see a plethora of hotels and vacation rentals all in one responsive map of the area.

What if I need more space than I can get at a hotel?

We use Vrbo for the times when we have rented a cabin for a weekend getaway, like this cabin in Townsend, TN, or needed to rent a house for a large family vacation. We had a great experience with them in terms of refunding deposits when COVID hit and will continue to use them.

Click here to search for a vacation rental.

Who do you use for rental cars?

As a general rule, we book with Hertz for rental cars. We have had nothing but good experiences with them. Plus, we really like unlimited mileage and not worrying about crossing state lines. We have even rented from Hertz overseas in both Slovenia and Croatia.

Click here to book a rental car.

How about booking a cruise?

We have found some amazing prices for booking a cruise through Cruise Direct. We have saved a lot of money on our cruises compared to what we found elsewhere, making a last-minute Bahamas cruise even cheaper.

Click here to book a cruise.

What if I want to rent an RV?

We highly recommend Outdoorsy for RV rentals. We rented a camper van for a week to visit Rocky Mountain National Park for the elk rut and Custer State Park for the Buffalo Round-Up and had a blast. The program was easy to use and we really enjoyed the freedom of having a camper van for that trip.

Click here to rent an RV.

What do you use for booking tours?

We don’t often book tours. Typically, we like to do stuff on our own. That said, there are some experiences you can’t have any other way. So, when we do want to book a tour, we always check Viator first.

Click here to book a tour.

Do you use anything to get discounts on the road?

We make extensive use of both Good Sam and AAA on the road. Good Sam is normally regarded as a discount card for RVers at campgrounds and Camping World but anyone can use the 5 cents off a gallon at the pump at both Pilot and Flying J.

Click here to get a Good Sam membership.

We have had AAA as long as we have been married and it has more than paid for itself in discounts at hotels, aside from the peace of mind of having roadside assistance. Add in paper maps and the ability to get an international driver’s license and it is more than worth it for any traveler out there.

Click here to get a AAA membership.